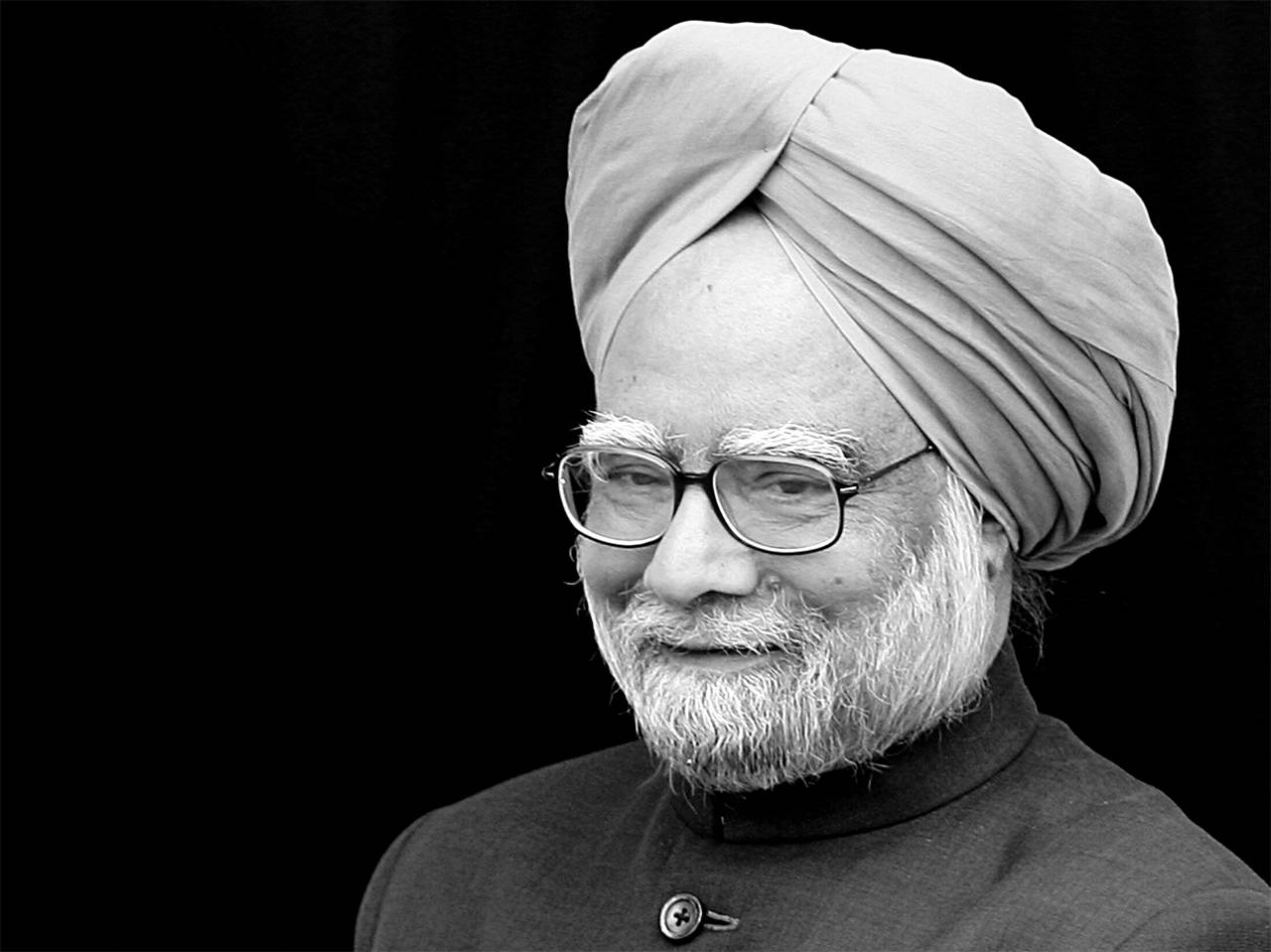

The introduction of the Goods and Services Tax (GST) marked a significant change in India’s tax system, promoting a unified approach under the slogan “one nation, one tax.” However, this centralisation has reduced state autonomy, particularly affecting Goa’s economy. The current GST framework limits the state’s ability to establish its own tax rates, undermining local industries and services—key elements of Dr Manmohan Singh’s vision for cooperative federalism.

A decentralised GST model would enable Goa to customise its taxation policies to suit its unique economic environment. With greater control over tax rates, the state could better support its flourishing tourism sector, fisheries, and niche manufacturing industries. This flexibility is vital for smaller states like Goa, which struggle to compete with larger industrialised regions on economies of scale.

Dr Singh’s economic reforms highlighted the significance of financial autonomy for states, allowing them to attract investment and nurture local industries. Under the current GST regime, Goa must adhere to uniform tax rates that do not consider its specific challenges. This one-size-fits-all approach stifles innovation and local entrepreneurship by removing the capacity to incentivise sectors where Goa holds a competitive advantage.

Moreover, the GST Council, although intended as a collaborative body, has often prioritised central interests over state needs. Delays in compensating states for revenue losses further undermine trust in this system. In contrast, Dr Singh’s approach encouraged dialogue and collaboration through institutions that integrated state priorities into national planning.

To revitalise its economy and encourage sustainable growth, Goa must advocate for a decentralised GST framework that restores its autonomy in taxation. By doing so, the state can align its economic strategies with local realities, ensuring that every region possesses the necessary tools to thrive in a diverse and dynamic India.